One of the hottest growth areas for subscriptions is farming. Surprising? Maybe. But with small margins and big numbers, efficiency matters. And farming has become an increasingly high tech, high stakes business. Justin Rose is the President of Lifecycle Solutions, Supply Management, and Customer Success at John Deere, a 187 year old company with revenues in 2023 of over 61 billion dollars.

You probably know them for their tractors, but they’re investing heavily in subscriptions.

In today’s conversation, Justin and I talk candidly about why this manufacturing company has committed to reaching 10% of annual revenue in software subscriptions by the year 2030, the right and wrong way to accelerate transformation through acquisition, and how to maintain the trust of long standing customers when you change the business model.

—

Listen to the podcast here

How SaaS & Subscriptions are Transforming Farming with John Deere’s Justin Rose

One of the hottest growth areas for subscriptions is farming. Surprising? Maybe. But with small margins and big numbers, efficiency matters. And farming has become an increasingly high tech, high stakes business. Justin Rose is the President of Lifecycle Solutions, Supply Management, and Customer Success at John Deere, a 187 year old company with revenues in 2023 of over 61 billion dollars.

You probably know them for their tractors, but they’re investing heavily in subscriptions.

In today’s conversation, Justin and I talk candidly about why this manufacturing company has committed to reaching 10% of annual revenue in software subscriptions by the year 2030, the right and wrong way to accelerate transformation through acquisition, and how to maintain the trust of long standing customers when you change the business model.

—

Robbie Baxter: Justin, welcome to the show!

Justin Rose: Robbie, thanks for having me. I’m excited for it.

Robbie Baxter: So tell us a little bit about John Deere and subscriptions. I don’t know if everybody listening knows your story. If you could just share a little bit of background that would be helpful for grounding everyone.

Justin Rose: Yeah, I would love to. It’s always great to tell the story of a business that maybe a lot of people don’t think about as a subscription-oriented business. But given that, I’m guessing many. Your subscribers don’t know a lot about Ag. I find the industry really fascinating. So I thought maybe I would give a little bit of background. Technology is super prevalent and I think sometimes that’s underappreciated. But if I take one example, the job of planting and getting seeds in the ground, that seems pretty simple but really, what’s happening is that planters are running through bumpy, hilly fields. It’s dusty, it could be dry, it could be wet. They’re moving somewhere at or above 10 miles per hour, and they’re putting down 720 seats per second at exactly the right depth in the field. Now, that’s all driven by a GPS signal with correction to get to a sub-inch level of accuracy, and it’s instantly documented up to our cloud-based platform called Operations Center, which allows customers to be able to understand and analyze the operations. and it’s sort of a joke on Twitter that some of our customers say it’s the only app they use more than X or Twitter today. When I look at that, it’s sort of amazing. Actually, it blows me away—the technology at all different levels of the stack. And as crazy as that is, things are accelerating a lot. So we’re bringing a lot more technology to our customers more quickly than we ever have before.

But customers have two problems. One is that they don’t want to spend an enormous amount of money upfront to access that cutting-edge technology. The second issue is that there’s always a bit of skepticism that it will work in their operations, in their field for all the things they’re unique about, their farming. And so to overcome that, we’ve launched a new customer value delivery model that we call Solutions as a Service (SaaS), it is easy to remember. And the north star of that is to try and accelerate the adoption of technology to unlock more value for our customers more rapidly. If it’s okay, I’ll give you one tangible example of how that works in practice. And so in 2019, we reorganized our business in 2019 around what we call production systems. So that means customers that produce a certain type of crop. So think about corn, soybeans, sugar, cotton, or high-value crops like vineyards and orchards. So each one of them, as you can imagine, has unique needs and specific things that they actually want to make their operation the most profitable. And the idea was that we wanted to get really deep into the economics of those customers to understand how we could help them become more profitable, productive, and also more sustainable. And so if you think about corn production, the average in Iowa, which is basically the best farmland in the world, is about 200 bushels of corn per acre.

Now there’s a contest, and there’s a guy in Virginia. His name is David Hula, and by the way, he is a John Deere customer, and he often wins in the contest to see who can get the most yield out of a single acre last year. I think it’s just over 620 bushels on a single acre, so the best farmland in the world, on average, is doing 200. But it’s been proven that if you pay attention, if you actually monitor and measure each plant individually, you can triple that, so there’s a huge amount of value to unlock. But the scale of agriculture makes that really hard, and this will probably come as a surprise to your listeners as well. But every year in the United States, there are 10 trillion with a “T”. Corn and soybean plants planted 10 trillion. And so if you’re trying to get to a world where you can optimize every plant at the scale of trillions, you really need cutting-edge technology. And we think that our recurring revenue and subscription business model is the perfect way to get that to market and help customers adopt it seamlessly.

David Hula’s results, along with those from thousands of yield contest entrants each year, demonstrate the innovation and passion of the American corn farmer.

Robbie Baxter: Wow! Kind of blowing my mind right now, thinking about trillions when you talk about scale in each one of those plants. I understand the problem at least a little better than I did a few minutes ago. I’ve seen posts and announcements that you’re looking to have 10% of your revenue from these Solutions-as-a-Service (SaaS) by 2030. And I’m wondering why you set that goal and what approach you’re planning to use to achieve it?

Justin Rose: Yeah, it’s a great question. I would say we set that goal because we thought it was meaningful enough that we would have to commit as an organization to really do something different but also achievable. And so it’s in that perfect, sweet spot where we can’t just ignore it and then hope we kind of stumble into it at the end, but also, it’s not something that’s totally pie in the sky.

When we think about how we’re going to get there I would say, three different tranches of technology. One is something I describe as basic precision is what we would call the connectivity of the machines to the cloud. It’s the ability to do some basic tasks, like drive the precisely same line down each field each year or between each pass. Next, layer up we call sense an act. And it’s things like, you may have seen See & Spray, which is a technology that uses computer vision and machine learning algorithms to look at each piece of foliage as it goes through the field and determine if it’s a weed or if it’s a plant, and then it only sprays the chemical on the weeds to kill the weeds, and that saves something like 70% to 60%, 70% of the herbicide that otherwise would be used And then, at the top of the stack, is autonomy. And we’ve committed to building out a fully autonomous corn production system. So what that means in layman’s terms is that someone who wants to use the most cutting-edge technology should be able to farm corn by 2030 using only autonomous equipment and that, we think, is the real cutting edge. And then, of course, when you put those things together, the machines are connected.

Robbie Baxter: Does that mean that if I’m growing corn, I just put my John Deere tractor in the middle of a field and push a button? Netflix and chill or is there something more involved?

Justin Rose: You’re pretty close. I think that it’s interesting. I live in Austin, Texas, and we have a test farm down there, and I’ve taken a lot of customers and suppliers, and of course, other employees, to the test farm, and the tractor goes out in the field, and somebody, hops out of it, jumps in a Gator, and drives back to the base. And then, you make a big ceremony where you swipe right, and the tractor starts going, and everyone stares at it very intently for the first 2 or 3 minutes, and then they start talking amongst each other and looking back every once in a while, and then, after 5 or so minutes, they just don’t even look at it anymore. It’s quite boring. I mean, things just go up and down, they rose by themselves. That’s the idea.

We had a customer, and you could think about what that means for people in a couple of different ways. One way is, of course, well, you can take the labor out. And in the farm economy in rural America, like everywhere, there are labor challenges. And so the idea of being able to do so at key times during the season. Have the equipment run autonomously if you need it to so that you can get the job done at the right time. That’s a huge value in and of itself. There’s another example of a customer telling me at the end of the day, it’s just the ability to have dinner with his family and feel like he doesn’t have to be in the cab of the tractor for 18 hours during harvest or for a similar amount of time during planting. And so there’s a real, economic benefit, but also a real-world lifestyle type of benefit as well.

Robbie Baxter: Yeah, it’s interesting. I think you said that the reason that you’re offering this as a Solution as a Service (SaaS) as a subscription. Rather than saying, buy this technology or this piece of software to go with your hardware is, as you said, because of skepticism and because of cash flow. How has it been received by your customers?

Justin Rose: The way we do that is by doing three simple things. One is that it’s a lower upfront cost to access cutting-edge technology. Two, we are committed to them, they are only going to pay for what they need or what they use in the field. And three, it’s going to get better over time. And when you put in those terms, it’s almost like their mindset shifts very quickly, and they start saying, Well, if that’s true. if that’s really how you’re going to do it. If it really is a lower upfront cost, they start to really like the idea. And in some ways, why wouldn’t they?

If I go back to the scenes, for example, so maybe just a touch more on the technology. Think about a sprayer for those of your audience that maybe haven’t seen this or don’t have a visual that is 120-foot-wide boom, sometimes steel, sometimes carbon fiber on the back end, driving through a field, and if you think about it the traditional way, spraying everything, just coding it with herbicides to kill weeds. The See & Spray sprayer has that same boom. It has 36 cameras mounted all across it. It’s got six Nvidia jets and G processors that sit there and run in real time, like in dozens of milliseconds. Look at what’s in the field. Ingest that image, use machine learning to decide if it’s a weed or a plant, and then actuate the nozzle to spray in short bursts. And that technology, if you bundle all of that together and say, Hey, you have to buy that once, it costs you over two and a quarter million dollars. Now, what we’ve done this season is for our initial customers, we’ve offered an upfront price of 25k. And then you pay a subscription on top of that, and so for a customer, you put your customer hat on and say, “Well, I’ve lowered the barrier to trying it, because 250,000 is a lot, but 25k I could jump in and just test that out.” And then, if I don’t use it, if I find that it’s not working, I’m not paying the subscription. I only pay for the subscription when I’m actually using it on a pay-as-you go model. And so it’s quite an interesting way to break down those barriers that I talked about, that customers are skeptical about paying too much upfront, and ultimately, it’s not working on their operations.

Robbie Baxter: In many other businesses that I’ve seen where they’ve been a going concern for a long time, they have established customer relationships for transactional-based products— products that they own.

And then, SaaS, it isn’t introduced on top of it. One of the challenges faced is, do we sell it to our new customers when they’re buying the new equipment and we’ll layer in or introduce the concept of the software, or they already have products out on the market. And we’re going to layer this on and offer this as an upsell or as an additional option.

There are two things I really want to ask about this issue. One of them is, how did you think about where to launch this first and why? And then the second question is, I’m sure you saw the whole BMW heated seats, a debacle that everybody laughed about. BMW, one or two markets introduced an option. In the aftermarket, you could subscribe to heated seats if your car didn’t already have them. I live in Miami. I don’t pay for heated seats when I buy a new car, I sold it to you. You’re up in Michigan. Let’s say you want heated seats, you can turn that on for the next six months of the winter. See if you like it. Great flexibility. All the things you said, people hated it, and the reason, I think is that they we’re used to owning things outright. And that was the relationship. They had a deeply established a strong relationship with BMW. And this was a new way of engaging, and so an old product, a new way of paying, existing customers, and lots of issues.

So I’d love to hear you on this topic of new versus existing customers and new versus existing offerings, and how do you manage that?

Justin Rose: As you said to me, the big difference is what BMW did was take something that everyone intuitively thinks they already have, the heated seat, horsepower, there are all kinds of derivatives of that type of model, and they tried to monetize it and I think people just sort of rejected it, feeling like they were getting nickeled and dimed-like. I bought this premium car, which in my mind’s eye should have heated seats, right? I mean, that’s a little bit crazy, and now it doesn’t, and they’re asking me to pay more for that. And I think for us, the way we thought about it is that we are trying to put subscriptions around new cutting-edge technology that’s never been on the market before. And so again, if I use See & Spray, or I use autonomy as examples, those are things that no customer is familiar with or feels that it’s part of what the equipment should already do. And, in fact, the See & Spray that I described, if the customer doesn’t want to use the See & Spray technology, they can use the sprayer exactly as they always have, and they own it, and it operates in exactly the same way it always has. And so we have the ability to communicate. We’re making these large investments to drive cutting-edge technology. Buying it once would look like this, buying it from a subscription, a smaller one-time fee, and then an ongoing subscription look like this, and we can create price points in the market that help customers understand the logic and candidly direct them to where we want them to ultimately engage with us.

The way we thought about it is that we are trying to put subscriptions around new cutting-edge technology that's never been on the market before. Share on XRobbie Baxter: We do owe something to the BMW team and it is true, in this kind of space there aren’t that many examples of how you do it. And sometimes you don’t know what works or doesn’t work until you try. There’s good logic to why you try it. I mean the same thing with the New Coke. Right? There was good logic. They weren’t dumb people. They become the butt of a bunch of jokes but I could see making the same mistake. Are there other companies, products, or categories that you look at that provide you with insight? Whether in your industry or since you’re a leader in your category, and in other areas.

Justin Rose: When I think about where this type of model works and doesn’t in more of an industrial B2B space is a large piece of equipment type purchase, even automotive, to some extent. I think it’s got a much easier time working where there’s a clear value proposition that you can link to the technology itself. And so I described autonomy, of course, you get the labor at the time you need it. You save on hiring maybe an extra hand or labor. There are some emotional and just lifestyle benefits. To See & Spray, it’s probably even clearer. You finish spraying the field and what used to be the entire tank, you now have 70% of the tank of chemicals left. And so you can just literally understand the math almost in real time about what that means for doing that. So I think that industries where they can create and draw that clear cause and effect to use the technology and it has an ROI. On the other hand, I’ve seen an automotive company, for example, but even beyond BMW, companies trying to build services, businesses, recurring revenue businesses, and especially when the product is a B2C. Think about your personal car. It’s just hard to think about what that car is going to do that’s going to be better for me. Of course, I actually have dabbled in paying the subscription for Tesla’s full self-driving, and that has a certain value and by the way, if I did long drives and was tired and needed to work, I probably would pay you for that all the time. But if I’m just daily commuting, it’s a little bit tough to draw that value proposition out. So that’s how we think about it in our industry. Now we’re blessed, of course, because it’s kind of an easy answer that if you can create a clear delineation between do x and get y, it makes the economics pretty straightforward and the value proposition to our customers straightforward. Obviously, not a lot of industries have that benefit and so I think that, that’s where I tend to see more challenges.

Robbie Baxter: Yeah, I mean the one that comes to mind for me, we had a guest last season from Samsara who does fleet management do for cars and especially trucking, and what they did that I found really interesting is they took a step back and said, what is it that fleet owners struggle with? What are their goals? And what do they wish we could do for them? And kind of worked backward from that perspective, instead of getting better.

I tell my clients, you can look with your microscope and do this incremental improvement on what you’ve always done but there’s also using the telescope and saying, “Okay, big picture. What’s going on in the world? What are the problems that you’re trying to solve? I think this is always a really good tool if we were starting today with the same forever promise.” So in your case, to help farmers be as productive with as little time and expense as possible. What would we be building? What would we be doing? What do we think about it? Would we have ended up with the same machine? Or if we have done something different? If anybody’s listening, that’s really what I’m thinking through this question, I think Samsara is another good episode to listen to. But I think what you’re doing at John Deere, Justin, is these are the farmers’ biggest challenges, and they think very differently about them. That’s not what you’re known for historically but saying this is the best way to solve the customer’s problem on an ongoing basis.

Justin Rose: First of all, I think your Samsara example is a great one. They have the ability to create assets that are moving all around and then help optimize them and that’s really foundational. When you’re managing a fleet. There are other examples where companies outfit the equipment with all kinds of sensors and are then able to understand predictively and preventatively when it may break or need to be serviced. And then, on top of that, maybe selling a subscription to the parts or the service. Obviously, I’m sure you’re well aware that it’s a slightly derivative business model. But what have all the aircraft engine companies done over time? And the thing, by the way, that I always found fascinating about that is that I learned as I studied them was that they start when they pitch a new contract for an aircraft engine, they set a price for service that’s below what they can do today. And they actually use all of the telematics and the diagnostics that they can pull off of the equipment to drive down their cost of service over time, and they’re making a bet on themselves that by applying themselves, they can reduce the cost by extending the intervals between where it needs to be serviced. such that they can ultimately make money on that contract. And I love that mentality of just betting on yourself and knowing that you have to be bold and aggressive in terms of how you’re going to actually try to create the first hook into the business and then do everything you can as an enterprise to drive, to make it more and more profitable for you over time.

Robbie Baxter: Yeah, that’s a great example. Couple of things I want to pull out for listeners. One of them is this idea of really moving to outcome-based pricing. I used to think, when I was young and naive, that subscriptions were the be-all end-all but over time what I’ve really come to believe is that it’s about aligning outcomes with pricing, and betting on yourself as you describe it is really about aligning the outcome, saying, “Hey, we’re going to pay, we’re going to be in this together, and if you don’t get your outcome, we don’t get our money.” And that first of all, is good business. It’s good ethics. It’s good karma. It’s very attractive to businesses because it’s being told, “Hey, you don’t have to urge customers. You don’t have to take the full risk. We’re taking on a bigger piece of the risk because we’re confident in your goals being achieved.” But I also think it does something for the product team. And I’d love to kind of tear up this question for you about your internal teams as you make this transition to software being an increasing part of the overall business which is, a lot of times I see on-going concerns when they introduce subscription offerings, it’s sort of seen as a wraparound or an extra and it’s also seen as a sign that we’ll just keep doing our core business the way we’ve always done it. And you guys can wrap it up and package it as you want. Add other stuff. But it doesn’t affect us, and I think your example shows that you’re familiar with Boeing and Rolls-Royce, power by the hour. One of the things that happens when you start offering something on subscription is that it changes how you build the product. Newspapers have seen this, right? You want to have subscriptions rather than ads that are driving your business. You need to have articles that people are willing to pay for rather than articles that people are willing to look at, less Kim Kardashian and the royals, more bond trends, and election results. And ultimately, subscriptions often come in, I would say, off to the left. but eventually become core, and then actually tail-wagging the dog, changes how a business operates.

I’m curious, at John Deere, what kind of impact you’ve seen from the increasing importance of software in the way the whole business is ran and maybe even in the culture of what’s been a longstanding successful organization?

Justin Rose: Yeah, I love what you’re saying and I think it’s dead on. First of all, for those of you who don’t know, John Deere is 187 years old, it is one of the oldest public companies in the United States. And so there’s a super strong legacy and history with our customers in the places that we live and work that think we’re really proud of. But it is really challenging as well. There have been examples where we have tried to make big shifts again. I’ll go back to the See & Spray and say, “where did that technology come from?”

We actually acquired a company called Blue River Technology back in 2017. Blue River Technology was doing the same type of idea using cameras to understand where there’s weeds and then only spraying where the weeds were, but they were doing it at super low speeds in lettuce, If you’ve ever seen lettuce, it’s like one head of lettuce and then two open feet and another head of lettuce. So it’s very proper and etc. When we bought them, we gave them the challenge, we want to do this in corn, if you juxtaposition that with corn, you’ve got 9 feet tall, it’s all overlapping. It’s just a mess that you can’t even walk through the rows once it’s grown up to its full height, it was huge. It was using their same fundamental technology but it was a huge transformation for what they had to do as a business. And where I’ve seen a lot of companies go wrong, especially big companies, ones that are 100 years old or more, that are really proud they get this beautiful new technology. And then they try to integrate it and they say, “Hey, what you guys need is some of our financial management practices, or our HR overlay, or our security standards, etc.” And I know not all of that’s unavoidable. But at the end of the day, I think that’s the type of thing that tends to crush what made that thing special in the first place. And so we’ve tried to be really choiceful about where we integrate things versus where we don’t and how we continue to get the most out of the places that we’ve brought in technology from the outside.

Now, that’s half the story. The other half is just our internal work. And I couldn’t agree more that changing how we’re creating a business model is actually changing the product. We have examples of products that had very high adoption rates, i.e. someone had paid for them, but there was very low utilization. And historically, that wasn’t really our problem anymore. Right? If we didn’t, if they didn’t get the absolute max out of the piece of equipment, at the end of the day, we would have already sold it. It was sort of their job to do that right. We could give them the tools, but we couldn’t actually help them use them. We didn’t try to help them use it, and so I would say 3 years ago, for most parts of our business, we didn’t even look at utilization as a metric that we cared about. Now, as we’ve tied ourselves to subscriptions, as we’ve tied ourselves to some of the pay-as-you-go models that you were talking about, that is absolutely mission-critical. It’s not enough to ship something, even if we think it’s great anymore. We have to get customers to try it, turn it on, see the value, and help articulate it, and then ultimately close the loop and resubscribe, or choose to use it the next season as well and that cuts across everything we do, from how we think about instrumenting the technology to get data off to the intervals at which we even review, like the progress of the technology, to how you feedback to the development cycle and even how you budget things again.

It's not enough to ship something, even if we think it's great anymore. We have to get customers to try it, turn it on, see the value. Share on XIf I think about our business traditionally, it would be a big capital investment to build a new tractor, and then they would kind of tail off, and you’d launch a tractor, and you’d be good. In our business, we’re now developing cutting-edge software on top of cutting-edge hardware. You have to have continuous R&D pretty much in perpetuity. If you want to have it, customers will continue to use it.

Robbie Baxter: Yeah, you highlighted a bunch of changes. I appreciate the comments on acquisition challenges and kind of blending two companies and two cultures. Also, you brought up the issues around speed and iteration, continuous tinkering versus a hit model where it’s like you come out every few years with a big hit jazz hands and hope that you hope the critics love it because it’s a big bet versus lots of little bets. And it is, I think, a very different way of doing business. I assume you’re kind of the big champion within the leadership team of this piece of business. How are you bringing in your colleagues to help them understand the changes that are required, not throwing the baby out with the bath water, but using this to build a stronger business and better serve your farmer customers?

Justin Rose: Yeah. Well, first of all, I don’t want to take too much credit for my colleagues. As you know, they are my boss and all my peers. They see the vision, they understand why we’re trying to do this, and they’re bought into that. We have a really strong foundation as a leadership team of alignment. Now, that’s not to say there are no debates or points of friction, because the way we’ve organized ourselves, we have business units that own large agriculture, small agriculture, construction, and forestry operations. And so they’re charged with driving to a Profit and Loss (PnL), making quarterly results, growing the business, and making it very profitable. On top of that, we start moving to this more subscription model or recurring revenue model. And one of the hallmarks of that is that we’ve chosen to try to lower the upfront barrier of cost for a customer to adopt, then drive it with utilization and/or subscription annually and make it back over time, and the economics of that when you look at the unit economics on a life cycle basis are great. There’ll be, I think, even better than our traditional, most successful businesses.

Today, however, in year one, it’s not great. In year two, it’s typically not great. In year three, it’s maybe breakeven and so on. And so you are actually betting on a bunch of unknown factors. What will be the churn rate in our customer base? How much utilization will we actually get out of the technology if we continue to improve it? Will we have the ability to take a little price and compensate with more increased value over time? And all of that is spreadsheet math. But for them running their PnL, the reality is right now that it hits them. That’s an investment they have to make. And so, we have this constructive tension in our organization that we’re trying to understand how much confidence do we have in the years ahead? How confident are we in making significant investments now? Or how do we meter that in a way that works for our overall enterprise economics? And it’s a really good discussion. I think it’s your point about how the business model has changed the product. I think it’s also changed how we think about our business in a lot of ways. How we think about making those upfront investments and seeing that through and learning as we go and trying to drive different outcomes as best we can with customer success teams and leveraging technology to understand what’s going on in real time.

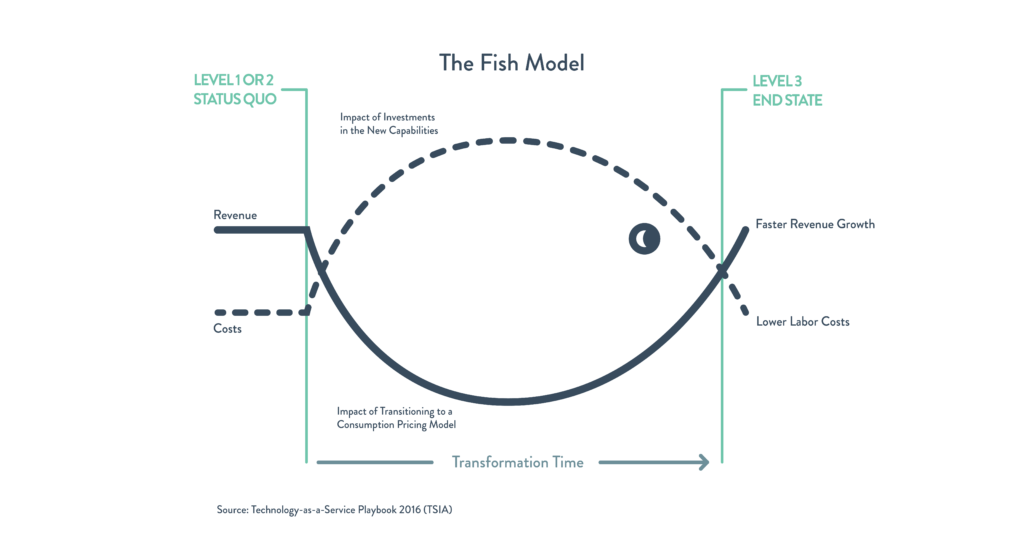

Robbie Baxter: Yeah, there’s a concept we’ve talked about it a few times on the podcast concept of Swallowing the Fish, This idea that as you introduce subscription businesses, your costs go up, as your profit goes down, and your revenues go down, and it kind of looks like a fish. And you’re kind of, holding your breath until those two lines cross back in the revenue higher than costs area again, and that whole fish swallowing cycle takes, for a lot of organizations 4 to 6 years or even more, and that there’s an issue that I’ve seen with some organizations where they’re all in at the beginning, and they say they understand this, and you get into, let’s say year 3, you need short-term revenue. You need profit. And, there’s this pressure to slow down or cut corners on what is, really a long-term play.

Swallowing the Fish: The idea that there’s a period in time where your costs are going up, even as your revenue is going down when you’re moving to subscription

Justin Rose: We’ve talked about the fish a lot as a team, and ultimately, I think that to your point, you have to have the conviction to see these investments through because you’re wasting your time and your effort. If you only go one, two, or three years, and then you pull the report and try to get out and do the counterintuitive thing. Maybe this is obvious to everyone, but it gets worse the more successful you are. So imagine you have an offer that takes off and all of a sudden, during that period of upfront investment, your revenues are coming down because you’re moving more people to this new model, and your costs are going up. The more units you sell in that world, the worse it actually is. And so the worst case is that, from a financial standpoint, you are hugely successful. Now, the out-of-year economics are amazing on that and it’s worth doing. And that’s where we’re spending a lot of our time trying to understand what we can absorb and then what we should expect, and then not just thinking about the overall portfolio, because that gets confusing with the piece of equipment that I sell with that model attached in 2024 versus 2025 versus 2026. When I group that all together, it gets messy because some are at different stages of their life cycle in that fish journey. But if you look at the unit economics of just the 2024 vintage technology that we’re putting in the field, how is that performing? Where is that in the life cycle? How does that compare to what’s happening in 2025 and 2026? And you can start to extrapolate out and tell the story of what investors and your own employees are going to see over time, with increasing confidence as you build scale.

Robbie Baxter: Yeah, there’s definitely a learning curve internally but also, as you said, by educating your board and your shareholders, how to look at numbers differently, how to look at unit economics, and how to look at cohorts or use of vintages.

Month one. What are people doing? What are the people who are going to engage for the long term doing? And how is that different from the ones that don’t? And what do we learn? And all of that is so important to invest in and recognize before you embark on this journey to swallow the fish, which is not my concept either. Sadly, I wish I thought of it, but it’s a JB Wood at TSIA, who came up with that idea. And we’ll have an image in the show notes. but it’s such a good thing to understand before you launch on this journey so that you’re prepared, you’re really investing in the long term. And I actually think companies that have been around a long time are hard to change. Often, they’re the ones that are really good at doing this kind of massive change because they have such a long sightline, right? They’re thinking about what to do for the next generation, and I know my own experience has been working with closely held family-owned businesses, not that in this case. Those are some of the companies that do the best with subscriptions because they’re thinking about the next generation. Are we building a value-book business as opposed to am I going to hit my number in the next three quarters before I move on to the next opportunity.

Justin Rose: I 100% agree. I think we’re going to attempt to do both but we will see how we go, and we’ll continue to refine and learn over time.

Robbie Baxter: Awesome. You talked about SaaS, what about Machines-as-a-Service (MaaS)?

Justin Rose: Part of the success in this journey is also just about focus. And so we have a really big pipeline of technology that works in the value proposition that I’ve been describing, where it’s seen as additive, there’s no conflict with, “Hey, I already own this thing or am going out on it.” And so we’ve been focused on that and we haven’t actually started with Machines-as-a-Service (MaaS) in our business.

Now it’s interesting that you ask, because as I’ve visited dealers around the world, from North Dakota to India to Africa, There are some that are starting to dabble in this across different markets, and we’re definitely keeping an eye on it. Now, the value proposition is that maybe it’s not all your Machines-as-a-Service (MaaS), but maybe it’s a portion of your fleet. So if you think that I probably need three and a half tractors for my operation, well, why not buy three and use that extra half capacity when you really need it, pay for it as a service. All kinds of different models like that. And so it’s something that’s very interesting. I don’t think we’re philosophically opposed to it, it’s just not been our focus so far. So if our customers tell us that they think it’s valuable for them, we would certainly look into it.

Robbie Baxter: Awesome. Well, I could keep going for hours with questions, and I hope maybe we can get you back on the show at some point in the future for the next chapter of the story.

Before I let you go, I’m wondering if you’re up for a speed round?

Justin Rose: Let’s do it. Fire away.

Robbie Baxter: First subscription you ever had?

Justin Rose: It’s probably a video game pass. I don’t even remember what one I played on Nintendo back in the day, so I would guess something Nintendo-related.

Robbie Baxter: Awesome. We had Mike Blank from Electronic Arts on the show to talk about video games a few seasons ago. It’s one of my favorite clients and favorite topics.

Justin Rose: Mine too.

Robbie Baxter: Favorite subscription today for personal use?

Justin Rose: I subscribe to supplement packs. And so, I used to try and piece together different vitamins and supplements to take, and I found one that I actually really am into. And they keep it easy for me. I get a little packet and a little sachet that I take, and I can carry them on the road with me. So that’s probably my favorite.

Robbie Baxter: What’s the story with the puppy in the tractor on your LinkedIn profile?

Baby Tag on Gator

Justin Rose: Yeah, that’s my dog. The fourth member of my family. I’m married, I have a 9-year-old, a 6-month-old little boy now, and we have an adorable golden retriever puppy. So that’s actually up at my family’s lake home in Minnesota. It’s the oldest piece of Deere equipment we own. It’s an old Gator, work vehicle, and he just loves to run around in it and enjoys tooling around when he’s not swimming in the lake. It was a super cute picture and emblematic of kind of how I feel about the John Deere Brand. It’s something that we can all connect to that has depth and meaning to it, and so I thought it seemed appropriate.

Robbie Baxter: Yeah, until your child says they want to be in the picture.

Justin Rose: I can see that coming for sure.

Robbie Baxter: I see you’ve worked all over the world, Thailand, Japan, and Mexico. Other than the United States, what’s your favorite place?

Justin Rose: Gosh! I honestly don’t want to be lame, but I get so much everywhere I go. I lived in Bangkok for almost 2 years, and so I would say there, because of the depth of friends that I built and the amount of culture I was able to consume. I spoke the language now. This was back in 2004 and 2005, so for a while I could actually speak some Thai and get away with it. So, I just think it’s a beautiful country, they’re wonderful people, and the food’s awesome. It’s hard to go wrong there.

Robbie Baxter: And final question, what advice do you have for other manufacturers?

For example, in the automotive industry where we discussed how they invest in Solutions-as-a-Service (SaaS)?

Justin Rose: I already talked about the need or how it’s easier if you can create linkages to real value creation, so I won’t cover that again.

But the second thing I’d maybe say is that investing in the infrastructure to make subscriptions work. So everything from investing in a license management platform so that you can manage offers and create bespoke customized offers for customers. That’s a big difference. Everything you and I talked about in terms of internal change management. Practically, but also culturally, to what it means. I think I would group that all under sort of the infrastructure to make subscriptions work, and that’s a place that if I were embarking on this journey again, I would put even more time and attention earlier.

Robbie Baxter: Justin Rose, thank you so much for being a guest on Subscription Stories. It’s been a real pleasure to have you here.

Justin Rose: It’s been a pleasure to join you. I hope you have a great rest of your day.

—

That was Justin Rose, the President of Lifecycle Solutions, Supply Management, and Customer Success at John Deere. For more about Justin and John Deere, go to Deere.com. And for more about Subscription Stories, as well as a transcript of my conversation with Justin, go to RobbieKellmanBaxter.com/podcast.

Also, I’ve got a favor to ask. If you like what you heard, please take a minute to go over to Apple Podcasts or Apple iTunes and leave a review. Mention Justin in this episode, if you especially enjoyed it. Reviews are how listeners find our podcast and we appreciate each one. Thanks for your support and thanks for listening to Subscription Stories.

Important Links

- Justin Rose, President of Lifecycle Solutions, Supply Management, and Customer Success at John Deere

- John Deere

- Operation Center

- David Hula, Winner of the National Corn Yield Contest

- See & Spray

- Autonomy

- New Coke

- Subscription Stories Episode: Keeping Complex IOT Subscriptions Simple for Customers with Samsara CPO Jeff Hausman

- Blue River Technology

- Forestry and Logging

- Agriculture

- John Deere’s Team

- JB Wood’s Swallowing the Fish

- Subscription Stories Episode: EA’s Mike Blank on Keeping a “Player First” Mindset within a Subscription Business

About Justin Rose

Justin Rose is President, Lifecycle Solutions, Supply Management, and Customer Success.

Justin Rose is President, Lifecycle Solutions, Supply Management, and Customer Success.

In this position, which he assumed in October 2022, he is responsible for leading the company’s worldwide aftermarket, customer support, supply management and logistics, precision upgrades and business transformation groups. He also oversees achievement of recurring-revenue and customer-success goals.

Prior to joining Deere, Rose spent 20 years at Boston Consulting Group (BCG), a leading international business-consulting firm, where he was a senior partner and managing director. There he worked with Deere on a series of high-profile projects and was instrumental in the development of the smart-industrial strategy and operating model.

In his most recent assignment, he headed BCG’s North American industrial-goods practice and was a member of the global leadership team. He worked at offices in Austin, Chicago, Bangkok, Tokyo, and Mexico City while at BCG.

A Minnesota native, Rose attended Northwestern University, where he earned bachelor’s degrees in mathematics and economics in addition to an MBA. Among other achievements, he co-authored a book about U.S. manufacturing and was recognized as one of Chicago’s 20 emerging business leaders. Justin serves on the advisory committee of the World Food Program’s Innovation Accelerator, as well as a member of the Board of Directors for the Central Texas Food Bank.

Love the show? Subscribe, rate, review, and share!

Join the Subscription Stories Community today:

- robbiekellmanbaxter.com

- Robbie Kellman Baxter on Instagram

- Subscription Stories: True Tales from the Trenches on Apple Podcasts