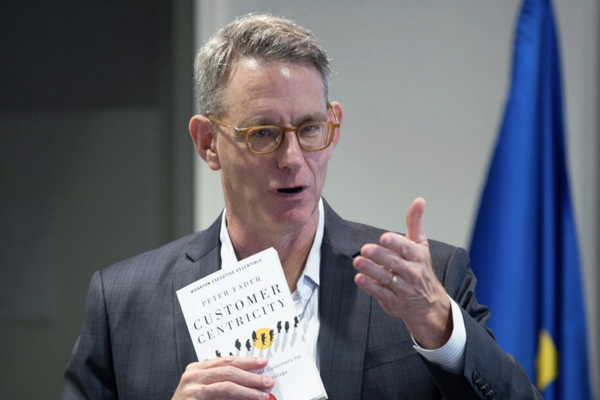

Customer-centricity is essential in the world of subscriptions. To succeed you have to understand who your most valuable customers are, and invest your resources in those relationships. But measuring the value of each customer over an extended period of time, and understanding which metrics matter most, can be tricky. Peter Fader, the Frances and Pei-Yuan Chia Professor of Marketing at the Wharton School at the University of Pennsylvania, is perhaps the leading expert in the world on how to assess the value of a business by understanding the value of the customer over their entire relationship with an organization from source to completion.

Peter has literally written the book on customer centricity. Well, actually, two books: Customer Centricity: Focus on the Right Customers for Strategic Advantage and The Customer Centricity Playbook which he co-authored with Sarah Toms.

In this episode, we discuss customer-centricity, customer lifetime value and how to use available public data to evaluate a company–using D2C prescription glasses retailer Warby Parker as an example. We also talk about why current accounting standards don’t always tell the full story–and how this needs to change.

—

Listen to the podcast here:

The Quantitative Side of Customer-Centricity with Wharton’s Peter Fader

Customer centricity is essential in the world of subscriptions. To succeed, you have to understand who your most valuable customers are and invest your resources in those relationships but measuring the value of each customer over an extended period of time and understanding, which metrics matter most, can be tricky.

Peter Fader, the Frances and Pei-Yuan Chia Professor of Marketing at the Wharton School at the University of Pennsylvania is perhaps the leading expert in the world, on how to assess the value of a business by understanding the value of the customer over the entire relationship with an organization from source to completion.

Pete has literally written the book on customer centricity. Actually it’s two books, Customer Centricity: Focus on the Right Customers for Strategic Advantage and The Customer Centricity Playbook, which he co-authored with Sarah Toms. In this episode, we discuss customer centricity, customer lifetime value and how to use available public data to valuate a company using D2C prescription glasses retailer, Warby Parker, as an example. We also talk about why current accounting standards don’t always tell the full story and how this needs to change.

—

Welcome to the show, Pete.

Robbie, it’s always a pleasure talking to you.

You were a math major at MIT, but you’ve ended up a marketing professor. What happened?

I keep asking myself that like, “What?” It’s not like anyone wakes up one morning and says, “Mommy, I want to be a Marketing Professor.” It was gradual brainwashing. There was this one marketing professor at MIT. She’s now at the University of Texas at Austin, Leigh McAlister. She came up to me during my senior year and said, “All that math stuff, all that statistics, numbers and patterns that you like, you ought to go into marketing.” I looked at her and said, “You ought to get your head checked.”

Not intuitive?

Yes. Saying, “I’m a math guy. I’m not going to marketing.” It is the last thing I would think about. This was 1983 and she painted a picture of what marketing would become. She casually called it, “We are building the electron microscope of the customer and we’re going to know so much about the customer, who they are, what they do and what they are going to do next. All of that math stuff is going to help us not only understand the customer better but leverage it. Make better decisions and help companies, spend their money more effectively and get more for it.” I didn’t quite believe her but she was very persuasive and so I followed along. Here we are many years later. Was she right? I’m in the right place and the right time for myself. I have been so happy to be swept along by that tide of everything that marketing has become and is still becoming.

Customer Centricity: All of that math stuff is really going to help us not only understand the customer better but leverage it and make better decisions and help companies spend their money more effectively and get more for it.

Marketing is really quantitative these days.

It certainly should be. That is not to say it shouldn’t be qualitative either. It’s not to say that the creativity and the interplay of creativity, qualitative, quantitative and even instinct should be part of it but no one of these things should come at the expense of the others.

The specific space in marketing where you work is very much like what your mentor predicted many years ago. In terms of being quite quantitative and taking a very close look at customer behavior, you are probably the world leader in studying customer centricity. Can you define what it means for you when you say an organization is customer-centric?

I don’t know if I’m the leader or not but I certainly enjoy messing around and saying a lot about that. One of the mistakes I made is that expression customer centricity means so many different things to different people. Sometimes it means things that are actually polar opposite to each other. Honestly, it was a bad choice of words, although it was the right overall concept to go after.

Here is my take on it. There are a lot of companies that claim to be customer-centric by saying, “The customer is at the center of everything we do.” That’s not what I’m talking about and when companies say that, I tend not to believe them anyway. For me, it is more about, “Which customer should we be centered around?” As we built that electron microscope of the customer, one of the big and shocking things that we found, it is trite by now but it was shocking at the time, is that customers are wildly different from each other.

There is no “the customer”. We can’t paint a picture of what the customer wants and we can’t develop products for the customer, which customers are we talking about? The idea of customer centricity is that they are wildly different from each other. Instead of trying to be everybody’s best friend, you got to pick and choose.

You got to figure out who are the customers that you are going to spend disproportionate resources on and once you figure that out, how are you going to allocate those resources? How are you going to listen to them, anticipate their needs and surround them with a variety of products and services? Many of which you don’t even make any money on to deepen that relationship, to build that forever transaction and to quote someone I deeply respect. The sense of customer centricity is, it is figuring out the difference across the customers and how to leverage them most effectively.

Like you, I have built my career around a highly charged term, in my case, a membership that means a lot of different things to different people. What I appreciate about the way that you refined your definition is that it is not about this general customer first but it is more about saying, “We are going to analyze our customer base first and then make decisions based on that analysis.” It’s a different way of thinking about customer-centric. It’s starting with your ideal member or customer and then saying, “What products and services should we offer to them? How should we allocate resources to optimize relationships with them?” First of all, is that accurate? Did I capture it?

You did well. In fact, a nice way to think about the contrast between what we are talking about customer centricity and the more traditional way of doing business product-centricity. It was summarized in a wonderful book called Designing the Customer-Centric Organization by a gentleman named Jay Galbraith. He talks about all these contrasts and one of them is for traditional product-centric firms. It is all about divergent thinking.

We got this product expertise. What else can we do with it? What new products can we spin off of it? What new segments or geographies can we take our product expertise to? Where can we spread the product out to? That is the way most companies think. It is the way most companies continue to think. Even when they are talking about being customer-centric, they are not. They are saying, “Which customers can we find to buy our product?”

Customer centricity means so many different things to different people. Sometimes, these are opposite to each other. -Peter Fader, @faderp Share on XCustomer centricity when we really mean it the right way is about convergent thinking. We’ve got these valuable customers here. How do we converge all of our thinking and resources on them? What products and services can we bring to them? What are the companies should we partner with? How else can we make their life better in order to lock them in and get more value from them, even if some of the stuff we are bringing to them is providing no value at all? If we can create that true bonafide relationship as opposed to hostage-taking, as a lot of companies truly think about it, that’s where the big payoff occurs. You can’t do that with everybody. It would be nice. You’ve got to pick and choose.

What do you mean by hostage-taking? Is that when you lock somebody into a subscription? Is that hostage-taking?

There are too many companies out there that delude themselves into thinking that they have a loyalty that they have real relationships with customers and that they have true membership. It’s because the switching costs are so high that the customers can’t leave. The switching costs might not be purely financial but there will be a variety of reasons.

Some are psychological and some procedural, “It is just not worth my leaving.” We can think of lots of companies, very often companies in the telecommunication space, where the customers aren’t getting their logo tattooed on their body parts. Let’s face it. They are there because it’s just a hassle to leave. That is not loyalty. That is not a true relationship. Unfortunately, these companies will convince themselves that they are because, “Look how long they have been with us.”

Don’t confuse inertia with loyalty.

Let’s clarify the difference and that’s my job is to use very careful statistical models to sort that out and figure out who are the customers who are choosing to be here versus the ones who don’t necessarily hate us but they don’t necessarily love us. If we could understand those differences and then doubled out on the right customers, that is the best path to growth.

You talked about these very precise models that you have developed. What are some of the metrics that go into your models that a customer-centric business should be tracking and using to make decisions?

Let’s first clarify what we mean by the models because it gives a black box flavor. There would be four main models. We are talking about four main behaviors that we want to understand, project and then use for these customer-centric purposes. It is all about acquisition, retention, repeat purchase and spends. If you think about it, that is where all of our revenue comes from.

If we can project how many customers are going to acquire, how long are they going to stay? How often they are going to interact with us? How much money we will make? How much value we will get when they do so? Those are going to be the four main models. Now how do we implement them? Is it going to differ from one setting to another? In some settings, we might have some other models. In some settings we might not have all of the four. There will be some differences there.

Customer Centricity: There are four main behaviors that we want to understand and project and then use for customer-centric purposes: acquisition, retention, repeat purchase, and spend.

Those are the four main behaviors. Naturally, we are going to want to have metrics that let us understand and then ultimately project each of those things. How many customers have we acquired each and every quarter or year? That’s a pretty obvious one yet, ironically, most companies don’t disclose it and the same thing is with retention.

A lot of companies will report different retention rates. It makes more sense for certain companies than others. Some companies on the repeat purchase side will say, “How many orders were placed by our active customers and spend the average revenue per user?” A lot of these metrics aren’t that radical. These are metrics that companies will talk about with some frequency. Taking it to a whole another step and sharing these things with external stakeholders and being held accountable for these metrics and their implications, that is what we are talking about.

I have two questions to follow-up on it that go in different directions. The first question is do the metrics and the models differ if you are looking at a business as an operator versus as an investor? I know you have spent time on both sides, working with operators and also working to help investors investigate corporate valuations. That’s the first question.

The metrics that I mentioned are going to be meaningful to both but internally, if this is our business, we will go beyond those basic counting metrics and start to use some of the projections. That’s where we get to things like customer lifetime value. Can we project? How long are you going to stay? What can you do over that horizon? How much are you going to spend?

Ultimately, that’s going to be more informative and it is going to help us make better decisions in terms of, what we are going to do and how well did we do it? Something like lifetime value, which is a composite of some of those metrics. We should be using that internally. We should be focusing on these forward-looking projections.

I’m not sure that we would want to share those externally because they are forecast and fallible. The last thing we want to do is to put forecast out there and have investors say, “You promised me that the lifetime value is going to be X dollars and it turned out to be Y.” There might be some distinctions between what we use internally versus what we disclose externally but they should be consistent with each other. They should ultimately tell a similar story, just with more detail and nuance if it is internal.

Some of those predictive metrics and then also the underlying metrics. That’s how I think about it. For example, metrics around engagement usage by cohort. Those are things that are helpful to the operators so that they can get in there and fix something when it is broken.

They would be helpful to the investors too but you can understand why a company doesn’t want to disclose more than they have to disclose, what we are pleased when they do. It means a lot to us and we do hope that the set of required disclosures will expand over time. That there are some interesting things happening on that front, which we might get into but it is understandable why there would be a difference between internal and external. They shouldn’t be inconsistent with each other.

I promised a second part to the question and it is right where you were going. Let’s talk about disclosure. You and your colleague Dan McCarthy was a guest on an episode of the show, have been proponents of greater disclosure, clarity, consistency and metrics from public disclosures from companies. I’m curious what you think organizations should be disclosing and what would give them an incentive to make those disclosures.

First of all, let me back up and give the biggest shout-out to Dan McCarthy.

The interplay of creativity, qualitative, quantitative, and even instinct should be part of marketing. -Peter Fader, @faderp Share on XI have benefited from his wisdom and experienced more than anyone on the planet. He was building all of these models of customer acquisition, retention, repeat purchase and spend. That’s something I have been doing for decades. Unusually, working directly with companies. Working directly with all of their rich transaction log data but it wasn’t until meeting Dan back in 2014. Dan after graduating from Wharton as an undergraduate went to work for a hedge fund and then came back to Wharton to get his PhD not just in Marketing but also in Statistics. He’s a real smart numbers and data guy.

I said, “Dan, wouldn’t it be great if we could take some of these models and be able to estimate them and use them when we are working with more aggregated data, the kinds of numbers that companies do or might put out there?” That became the basis of his dissertation. That became the basis of our second startup, Theta, which we might have talked about.

I have been learning so much from him. As marketers, it is funny because we were saying earlier on, at first, I was saying, “I don’t want to be a marketer.” As I became a Marketing Professor and you get arrogant and full of yourself and a lot of marketing professors, including myself to some extent, we would go to the finance people and say, “Finance people, you are doing it all wrong. You should be looking to all these customer data instead.” That’s not the way to make friends and win respect. Part of the education from Dan was, “The only way we are going to win this game is to play by the rules, the finances set up and find ways to get our models, metrics and language to fit in with theirs.

This is so important. It is often the marketers in my world that want to launch subscriptions or that want to enjoy membership economy principles in their businesses and they have to be able to communicate that to the finance team. It is one of the biggest hurdles that they often face. I’m really glad that you brought that up.

No one has done it better than Dan and in fact, in the subscription setting in particular. We found a way to thread that needle pretty effectively. To come up with metrics, models and the verbiage around them, that absolutely does full respect to all of the marketing thinking and all of the work that my colleagues in my field have done for many decades.

To make it appealing to the finance people, to get them to want to read our papers. To dive into the detail and explore some of the models for their own purposes. It has been an amazing ride in that regard and besides winning over finance is a great thing by itself. It ends up giving more respect, credibility and resources. Wind beneath the wings for the marketers as well when we can create a bonafide partnership.

What are the metrics that you use that you and Dan use? I know you have this customer-based corporate valuation, on the investor side. What are the metrics that companies should be disclosing if they want investors to truly understand how the business works?

It is going to be a long-winded answer. I want people to know where this is coming from. As part of Dan’s dissertation work, he looked at a lot of different metrics that companies have disclosed. We are not necessarily inventing anything new here. We are looking at what is already out there in terms of occasional or regular disclosures by different companies. That’s great.

Figure out who are the customers that you're going to spend disproportionate resources on. -Peter Fader, @faderp Share on XWe are going to do the math to basically say, “Which combinations of those metrics will let us best replicate the same models that we would build if I had the transaction log data?” and this is literally what we did. We had data from an actual company and we ran the models on the rich transaction by transaction data and then we said, “Which combination of aggregated metrics will let us come as close to that as possible?”

We found that not all metrics are created equal, and certain combinations of them were quite amazing at their ability to let us do that. Let me answer the question. This is less a matter of taste and judgment and it is a matter of math and statistics. What we found first on the basis of repeat purchasing, it is obvious in hindsight. Not a lot of companies necessarily have paid heed to it.

You are telling me the number of active users. Let’s keep it simple. The number of customers who have made a transaction with us every quarter, a year or whatever period we are talking about. Give me some notion of breadth. How many customers have done something, which again, might be transactions in a content setting and how many posted contents or at least visited the websites? How many active users have we had on each period of time and then we want a depth metric that compliments it?

Among those active users, how much activity did they do? What’s the average number of purchases by those active users or the average number of visits to the website, postings or whatever else? Give me one metric that reflects the depth and one metric that reflects the breadth and that’s going to tell me about the overall behavior of the existing users.

You got to give me a metric that reflects how many new customers we have acquired and then the fourth would be a metric that reflects the value generated by those activities. This is usually some notion of spend either what’s the average spend per user over the period as a whole or ideally, what’s the average spend per transaction or maybe both.

It comes back to those four behaviors: acquisition, retention, repeat purchase and spends. As long as we have a metric that reflects each of those things, perhaps even in an indirect way, we are looking good. It is remarkable to see how many companies, either by design or coincidence happened to reveal the dressed right set of metrics but even then, there is still the tip of the iceberg.

It is fun to look at your research. You published periodically deep dives on certain companies. Some in the subscription world and some while they don’t have a contract with the customer or a formal relationship with the customer, they are touting the loyalty and the habits that they are forming as a key part of their value. One of those companies that you took a hard look at was Warby Parker, the eyeglasses direct retailer. They have stores and they sell online. In leading up to their IPO, they filed an S-1. You and Dan went through that with a fine-tooth comb.

First, let’s give Warby a ton of credit for putting a good set of metrics out there. We wait with bated breath. Every time a company announces its IPO because we want to dive into the S-1 filing and see what’s there. It is like opening up a big box of chocolates. You never know what you are going to get. In the Warby case, it was quite good.

They gave us easily enough metrics for us to be able to piece together the different behaviors that I mentioned and an overall picture of the value of the customers. Therefore, the value of the company and was a pretty good picture. I’m happy to say that the unit economics of their customers is quite healthy as is the valuation of the firm. It doesn’t always happen that way. Some companies come in as pretty healthy, others are surprisingly not. Eventually, the market picks up on it. We are providing almost a sneak preview of how markets will shake out.

Customer Centricity: There’s a lot of companies that claim to be customer-centric by saying the customer is at the center of everything they do. It’s more about which customer should we be centered around.

It is also a sneak preview for companies that are in the subscription space, in the recurring revenue or membership economy space. That’s how investors are increasingly going to be looking at their filings so they need to be careful. One interesting example is Warby Parker. They had a lot of customer data, which was great.

One of the things that were interesting is you talked about unit economics. Unit economics is the Cost Of Acquisition or CAC. Can you share a little bit about how they looked at CAC? How you would think about the right way to look at CAC? What might that mean for other companies that are putting numbers out into the public?

It is so important that you raised this point, not only on acquisition costs but all of the costs associated with customers, the ongoing retention and development costs as well. While we are refining and popularizing the science of projecting all the revenue parts as I have already discussed, the way we figure out the cost parts is still kind of the Wild West.

I’m not criticizing the discipline of accounting but accounting for customers at a granular level. Not only granular one by one level but granular different kinds of behavioral level that hasn’t caught up but it needs to. There are no formal definitions out there about how you calculate CAC. The most natural way to do it, if we could, would be, “What was the total spend on acquiring customers? How many customers did we acquire and divide the 1st one by the 2nd one and there you go?

There are a couple of problems. Number one, how do we figure out exactly how much money was spent specifically for acquisition? For instance, Warby Parker, opening stores. How much of opening a store should be counted as acquisition cost versus cost of ongoing relationship management?

These things can get pretty tricky. What Warby did in their filing? I’m not saying they did anything wrong. I’m pleased they put so many good numbers out there but they took their overall spending divided by total active customers, not just customers acquired. When you look at the CAC numbers that they initially reported, they look really good but they were artificially low because they were being spread over a broader base.

Because they put so many good metrics out there, we were able to piece Humpty Dumpty back together and say, “What we think the actual CAC was because we could try to sort out the number of truly acquired customers from active customers.” We don’t have to run with the data they have, it is still informative but we’ll do the right fine-tuning to it.

This is one of the challenges that face companies, if you put the data out there that is most useful for understanding how they are doing. First of all, you run the risk of either people with different opinions or recognizing your errors. It is like getting a box of chocolates. You are putting out your valuables for everybody to see and judge, which is what companies don’t always like to do. Another one relating to metrics and to the communication of key data points. Twitter settled an interesting lawsuit about metrics and you were set to be an expert witness in that case for Twitter. Can you share what happened there?

Yes. It is a wonderful story because readers might get the impression that the more metrics, the better. If it is measuring something about customers then it should be disclosed and that’s not what I’m saying. I have described a bunch of metrics. How many active users and all that stuff? That doesn’t mean that more is necessarily better. It doesn’t mean that companies should disclose more.

In this particular case, Twitter would casually talk about some active user-type metrics, a number of them. Some of your readers might be familiar with DAU and MAU, Daily Active Users and Monthly Active Users. My view is if you put a single active user metric out there, that’s good enough. There are a lot of people out there who like to talk about the DAU and MAU ratio. What’s the percent of daily active users and relative monthly active users?

For years and years, even long before this particular lawsuit, I have pointed out and it is a technical thing. I don’t want to get into details but it is not very meaningful. It is not a good metric. When companies do disclose on a regular basis, I don’t want to say it is misleading but it is nothing. Twitter was sued for not disclosing the DAU and MAU ratio on a regular basis.

Customer Centricity: You have to think very carefully about what your business model is and what metrics support the relevant revenue-driving parts of it, instead of just doing something because your competitor down the street does it.

It was my job to basically say, “They shouldn’t be disclosing. It is not like they were hiding it. They were looking at a lot of different metrics.” This was one that they occasionally peak at but they didn’t find much use in it. It is a cautionary tale that not all metrics are created equal and you need to pick and choose carefully.

It’s because other people are using a certain metric, it doesn’t mean that you should, too. You need to think about your business. To double down on this particular case, if you think about Twitter versus Facebook. For Facebook, they are showing you ads and they are getting paid every time an ad comes across your Facebook Timeline. That’s not how it works with Twitter.

With Twitter, the advertiser doesn’t pay until someone actually engages with the ad, clicks on and does something. There are merely showing ads, merely knowing how many eyeballs showed up on Twitter in a given day. That’s not how they are making their money so they shouldn’t be disclosing metrics about it. You got to think very carefully about what is your business model and what are the metrics that support the relevant revenue-driving parts of it instead of doing something because your competitor down the street does it.

It is a really interesting one to me. I’m glad they were able to settle without having to go to court. It’s because you don’t present every metric, does not mean that metric is going to tell a different story about the business. In many cases and this is what you are getting to, the metrics that they weren’t sharing would have told the same story, wouldn’t have added to the understanding of the story of how the company is doing.

I will go further than that. It is not so much that they tell the same story. They might actually tell a confusing story. They might, in a weird way, disclosing those metrics. It could have misled the investors, as opposed to not doing so because it is a meaningless mishmash. It could create a false impression. It is really important and we have done the math.

We have looked very carefully to understand which metrics and which combination metrics will be the right indications depending on the business model. It is important for companies to walk before they run. Before you even think about disclosing anything else, focus on the core ones. Have the capabilities to measure them properly, report them properly, make the right inferences from them and then maybe start to go another step and expand on that set but do so cautiously.

One of the thoughts that are coming into my mind and goes back to our discussion about the relationship between marketing and finance. This whole area would be a very rich area for the head of marketing to be discussing with their head of finance to say, “Let’s look at these metrics and let’s put together the story. How can we best tell our story and how can we best communicate both externally and internally. How are businesses doing and to identify areas, certainly on the internal side, for improvement? What should be in our dashboard?” That would be a great place for discussion and collaboration between the two.

There's going to have to be some kind of great big crisis that arises from the disclosure or failure to disclose. -Peter Fader, @faderp Share on XI agree with you from your mouth to the CEO’s ears. The problem is very often these metrics fall in the crack between the CMO and the CFO. To be a little stereotypical about it, I know that it is wrong but the CMOs often is so obsessed with the brand. That a lot of these metrics are a little bit too wonky for them to worry about.

The CFO is obsessed with the very traditional metrics required by the Accounting Standards Boards (FASB, GASB, IFRS) and these other things they are saying, “We are not going there. If we don’t have to report it, we are not going to. Why should we?” What we are finding is that more enlightened CMOs and CFOs who see the value in these metrics for both internal and external purposes.

We have been talking to some big and publicly traded companies who have approached us to say, “What metrics should we disclose to paint the best possible picture for?” Again, we don’t want to give everything away. We are not going to post things on like forward-looking lifetime value but with simple counting metrics would help a savvy investor tell the right story about our firm, that they might not otherwise be able to tell. That’s the conversation I want to have and I want to see more companies doing that to the point where the Accounting Standards Boards eventually have to say, “We are going to set formal guidelines and regulations about these things.” It is not going to happen for years but I bet it is going to happen.

What I hear you saying is that historically, marketing and finance had such different ways of looking at the world that they often didn’t connect but increasingly as marketers are becoming more analytical and quantitative as their jobs are changing and becoming more numbers-based. Their goals are aligning more closely with those of finance and CFOs are realizing that they might have a very good ally in their CMO and in accessing the data that the CMOs are tracking.

From there, what follows is the best companies, the ones that are doing the best at driving customer lifetime value are going to be the ones most likely that are happy to share their numbers. It is because they are doing it right and they understand how to communicate that story. Hopefully, over time, that will lead to more companies following their lead and potentially even to a change in standards.

I’m going to flip it around. The companies that are willing to put the metrics out there are proud of them. They got nothing to hide. That doesn’t mean that all companies that are doing the customer-centric thing very well are disclosing. Most of them aren’t. Even if they are following all the acquisition, retention, repeat purchase and spend and doing it superbly well, many CFOs are still saying, “We are still not putting that stuff out there. Let’s keep that internal. That’s our secret sauce.”

Most companies are not going to disclose this stuff until someone forces them to do it. That’s why I spent a lot of time and I have mentioned it several times. I’m talking about the Accounting Standards Boards or the SEC. I want those kinds of organizations to step in and force this to happen so that the companies have no choice but to put these metrics out there.

Is that likely to happen? What will drive that to happen?

We have had a lot of conversations with both CFOs, investors, leading Wall Street analysts and just valuation experts. A lot of them are saying it is years and years away. There is going to have to be some great big crisis that arises from the disclosure or failure to disclose some of these metrics. It is going to have to be some company that goes bankrupt because of something that happens along these lines or a number of companies. It is such an overwhelming number of lawsuits.

I hate to get all technical with you but the crap is going to have to hit the fan before these Accounting Standards Boards are going to step in and they are not going to do, which is, “That’s a good idea. Let’s do that.” They got enough on their plate already. They are only going to do it when there is a problem to be solved.

It is just seeing some of these lawsuits. You have mentioned the Twitter one. There have been a number of lawsuits around the presence or absence of customer metrics but most of them you are probably not aware of them. As they become more prominent, at some point, the grownups are going to have to step in and say, “We got to avoid this from happening.” It is years away, and I don’t even know what the precipitating event will be but just like these metrics reflect the long run, we are in it for the long run. It is the right thing to do and we will find more companies doing it voluntarily. We will take a lot of these baby steps before some cataclysmic event happens.

I’m sure we will be following that closely. I wanted to wrap up with a speed round. Are you up for that?

Bring it on.

The first subscription you ever had?

The first subscription I remember would be getting cable TV as a kid and the whole idea of paying for television. It was very resonant because it went so far against the grain of everything that we believed in but it is a tremendous impact.

Were you involved in that decision? Was that a decision your parents made?

I remember so well, I was a teenager at the time. It was a parental decision but I was fascinated by it. Before I knew I’d become to do this for a living like, “How does it all work? What do we get for the money and all that thing?” I was very interested in it and continue to be. I have done a lot of work in the media space. Maybe it is a result of that traumatic experience as a kid. Pushing other media firms towards subscription businesses across the board, music, movies and so on and look at how the content world has changed. It has been just amazing and we haven’t seen anything yet. It is still changing a lot.

What’s your favorite subscription now that you subscribed to?

The favorite subscriptions would be the ones that you don’t question. The ones that you are doing it for the right reasons. If you are not being held hostage, I’m looking at the bill every month and saying, “Ugh.” I guess the one that brings me the greatest joy would probably be Spotify, and it goes back to the reason I said.

It is because I have always wanted that business model for the music industry. I invented Spotify before Spotify was founded. I didn’t really but the idea of that streaming subscription, get as much as you want. I don’t even know what I pay for. It is worth every penny. It is one that I celebrate as a sea change in the industry that’s surely needed it. Besides, I love that company and get great use of the service.

That’s always a great indicator that your subscription is good when your customers don’t know how much they are paying and say, “I don’t really care.” The last one. You are a business school professor. What is one business school class that every business person should take or should have taken other than your classes?

Most people probably shouldn’t take mine. What would be a must-take? Let’s be honest, negotiations. It is wonderful to see how those courses have become maybe the most popular event at any school. Learning how to play that game even if it has absolutely nothing to do with the stuff that I teach and talk about but I admire those skills so much. I wish I was better at them.

As the mom of three young adults, none of whom are in business school, I would love for all of them to take that class.

Maybe you don’t want them to.

It is funny. They are pretty good at negotiating with mom and dad but when it comes to negotiation in the broader world, knowing their value, understanding the considerations of the other side, forget business. Those are skills that everybody should have.

Life skills. No doubt.

Thank you very much for taking the time to talk to us. As always delightful and a real pleasure to talk to you.

Robbie, I always enjoy doing so and I really appreciate all the things you are doing to take some of these concepts, methods and technical stuff that I do and making it accessible, making it important and then getting companies to understand it.

Thank you.

—

Thank you so much, Pete. That was Peter Fader, Frances and Pei-Yuan Chia Professor of Marketing at the Wharton School at the University of Pennsylvania and customer centricity expert. To learn more about Pete and his work on customer centricity, go to PeteFader.com or Theta. Check out his books, Customer Centricity: Focus on the Right Customers for Strategic Advantage and The Customer Centricity Playbook, available online or at your local bookstore.

For more about my work with subscription and membership models, go to Robbie Kellman Baxter. You have been reading the blog. This is Robbie Kellman Baxter. If you love the show, please leave a review on Apple Podcast. Mention this episode if you especially enjoyed it. We read all the reviews and we want your feedback. Thanks for your support and thanks for reading the Subscription Stories.

Important Links:

- Peter Fader, Professor of Marketing of the Wharton School of the University of Pennsylvania

- MIT

- Leigh McAlister

- Buy Designing the Customer-Centric Organization

- Jay Galbraith

- Dan McCarthy

- Buy Customer Centricity: Focus on the Right Customers for Strategic Advantage on Amazon

- Buy The Customer Centricity Playbook on Amazon

- Sarah Toms

- Warby Parker

- Spotify

- SEC

- Pete Fader

- Theta

- Subscription Stories Episode with Dan McCarthy

- Subscription Stories: True Tales From The Trenches on Apple Podcast

- Wharton School at the University of Pennsylvania

- University of Texas at Austin

- FASB

- GASB

- IFRS

About Peter Fader

Peter Fader is the Frances and Pei-Yuan Chia Professor of Marketing at The Wharton School of the University of Pennsylvania. His expertise centers around the analysis of behavioral data to understand and forecast customer shopping/purchasing activities. He works with firms from a wide range of industries, such as telecommunications, financial services, gaming/entertainment, retailing, and pharmaceuticals. Managerial applications focus on topics such as customer relationship management, lifetime value of the customer, and sales forecasting for new products. Much of his research highlights the consistent (but often surprising) behavioral patterns that exist across these industries and other seemingly different domains.

Peter Fader is the Frances and Pei-Yuan Chia Professor of Marketing at The Wharton School of the University of Pennsylvania. His expertise centers around the analysis of behavioral data to understand and forecast customer shopping/purchasing activities. He works with firms from a wide range of industries, such as telecommunications, financial services, gaming/entertainment, retailing, and pharmaceuticals. Managerial applications focus on topics such as customer relationship management, lifetime value of the customer, and sales forecasting for new products. Much of his research highlights the consistent (but often surprising) behavioral patterns that exist across these industries and other seemingly different domains.

In addition to his various roles and responsibilities at Wharton, Professor Fader co-founded a predictive analytics firm (Zodiac) in 2015, which was sold to Nike in 2018. He then co-founded (and continues to run) Theta Equity Partners to commercialize his more recent work on “customer-based corporate valuation.”

Fader is the author of “Customer Centricity: Focus on the Right Customers for Strategic Advantage” (2020) and co-authored “The Customer Centricity Playbook” with Sarah Toms (2018). He has won many awards for his research and teaching accomplishments. Among these achievements, he was named by Advertising Age as one of its inaugural “25 Marketing Technology Trailblazers” in 2017, and was the only academic on the list.